Starbucks is not a coffee shop - it’s a bank | Fintech Friday - 34

Welcome to the 34th edition of Fintech Fridays.

Join 4,635 others who are receiving highly curated nuggets every week.

If you enjoy this, continue sharing it with your friends.

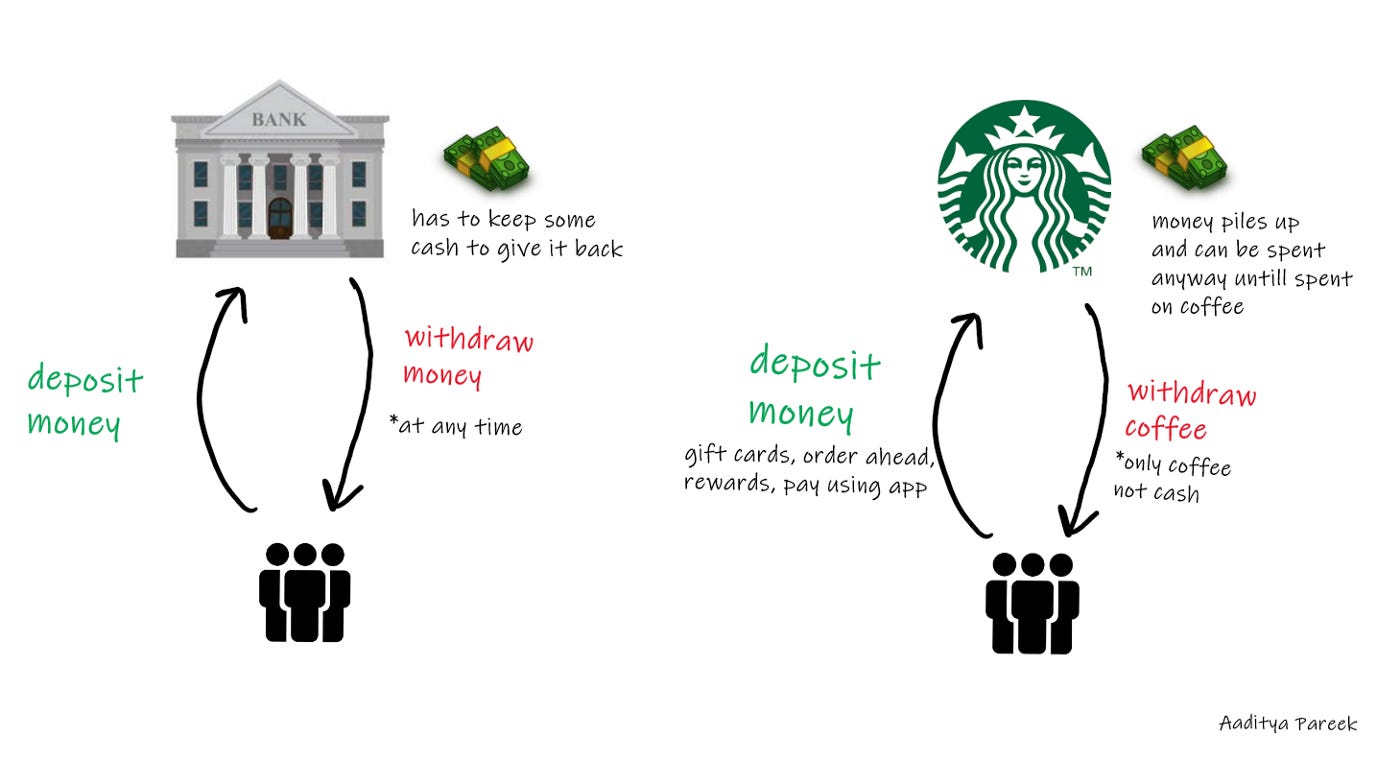

Have you ever heard the reference that McDonald’s is a real estate company that sells burgers or that Harvard and Stanford are in the hedge fund business with an education unit? Well, let’s take a look at one of that saying - Starbucks is not a coffee shop, it’s a bank.

In 1971, the first Starbucks café opened up in Seattle. Fast forward 50 years, it has become a global coffee giant. Today, they make 170,000 different varieties of drinks. With a $124.4 billion company, Starbucks trails only McDonald’s as the largest restaurant chain by market capitalization. So why do we say that they are a bank disguised as a coffee shop?

At the end of 2021, mobile transactions accounted for roughly 24% of total transactions. Most of them were purchased through a virtual Starbucks gift card. Today, roughly 44% of transactions are done with a Starbucks card. They hold about $2.4 Bn in cash uploaded by customers to be used later. That number is far higher than the deposits of multiple global banks. However, Starbucks is not a bank legally. Consumers cannot withdraw the cash balance in the card like a real bank and it can only be used to purchase coffee.

Another important aspect to note here is the breakage income of Starbucks. If a customer forgets that deposited money in Starbucks account or it never gets used due to some reason, that is known as breakage income. Starbucks’ annual report found a breakage income of $125 million in FY19.

The CEO of South Korea’s third-largest financial group stated in the past that Starbucks is an unregulated bank. We cannot be sure what will Starbucks do next. It could get involved in asset management through its prepaid cards, as well as the currency exchange, loan, and insurance sectors.

Podcast Recommendation

Thirty years ago, rich-world central banks started winning the fight against inflation. More recently, they have begun to fight new battles, including against Climate change or inequality. As the old enemy of inflation returns, in this podcast, host Soumaya Keynes asks if central banks are fighting on too many fronts.

In part one, Rachana Shanbhogue, their finance editor and author of a new special report on central banks, explains why the remit of central banks has expanded. Plus, former Federal Reserve Governor Sarah Bloom Raskin gives the inside story on her decision to withdraw her contentious nomination to run the central bank’s regulatory efforts, after pushback from Republican Senators over her views on climate change and monetary policy.

What Happened This Week in Fintech

Amid crypto downturn a16z debuts $4.5 billion web3 fund

Financekaart raises INR 10Mn of seed funding from renowned Angel Investors

Indian Fintech's success is an example of popular support for reforms: PM Modi

NAKAD, a supply chain fintech for Indian MSMEs, raises $7M in Seed funding

Debt investment aggregator platform Wint Wealth has scooped up nearly $15 million in a new round

Fintech startup SaveIn raises $1.1 million in funding led by Bayhouse Capital

Equitas Bank loses 28% of market value after founder announces plan to step down

Karnataka making Mangalore a FinTech Hub is becoming a reality

Seed Funding Opportunity up to Rs. 1 Cr

Startup Réseau has partnered with Relipay (RNFI Services Pvt. Lt.), to set up the “Bharat Fintech Venture Builder Program'' towards supporting emerging FinTech entrepreneurs and startups who are building for Bharat across various segments.

If you think you are amongst the fastest growing FinTech Startups, come and join us to serve the next billion users in the Indian market.

Apply now: https://bit.ly/3vWdh2Q